Vote NO on Mayor Johnson’s Transfer Tax Hike Referendum on March 19 Election

Mayor Johnson’s Transfer Tax Hike will hurt our entire City.

In the post-Covid era, with workers opting to stay home, high interest rates, and marked increases in labor and material costs, Chicago’s downtown faces momentous challenges, including record high vacancy rates and drastically discounted building values from 40 to 80 percent. Notably, several downtown office buildings have turned their keys over to the banks because they couldn’t afford the mortgage payments, nor could they find investors willing to purchase the buildings.

Even before the onset of Covid, investors were steering clear of Chicago. Concerns about Chicago’s property tax unpredictability, public safety, high government spending, and corruption were driving many of their location decisions. And with increased competitiveness from a growing number of cities – including smaller cities like Nashville, Austin, and Denver – investors have a variety of choices across the nation from which to select.

Now, as our downtown strives to overcome this incredible and unique challenge, we look to the City’s leaders to encourage downtown growth and investment. Instead, the City proposes yet another increase in the cost of doing business in Chicago that will further discourage investment in our great City.

We need a thriving downtown to ensure our whole city prospers.

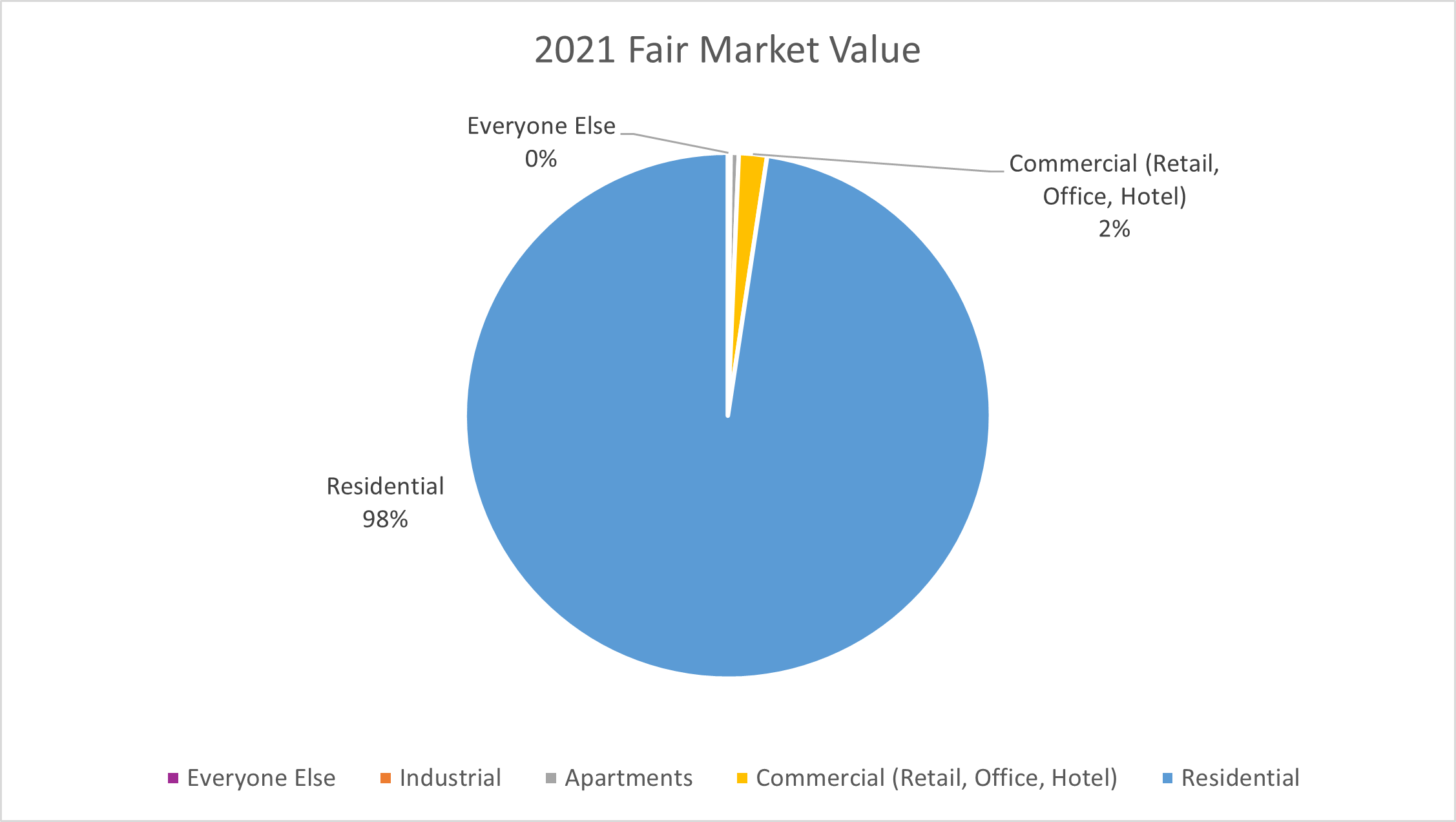

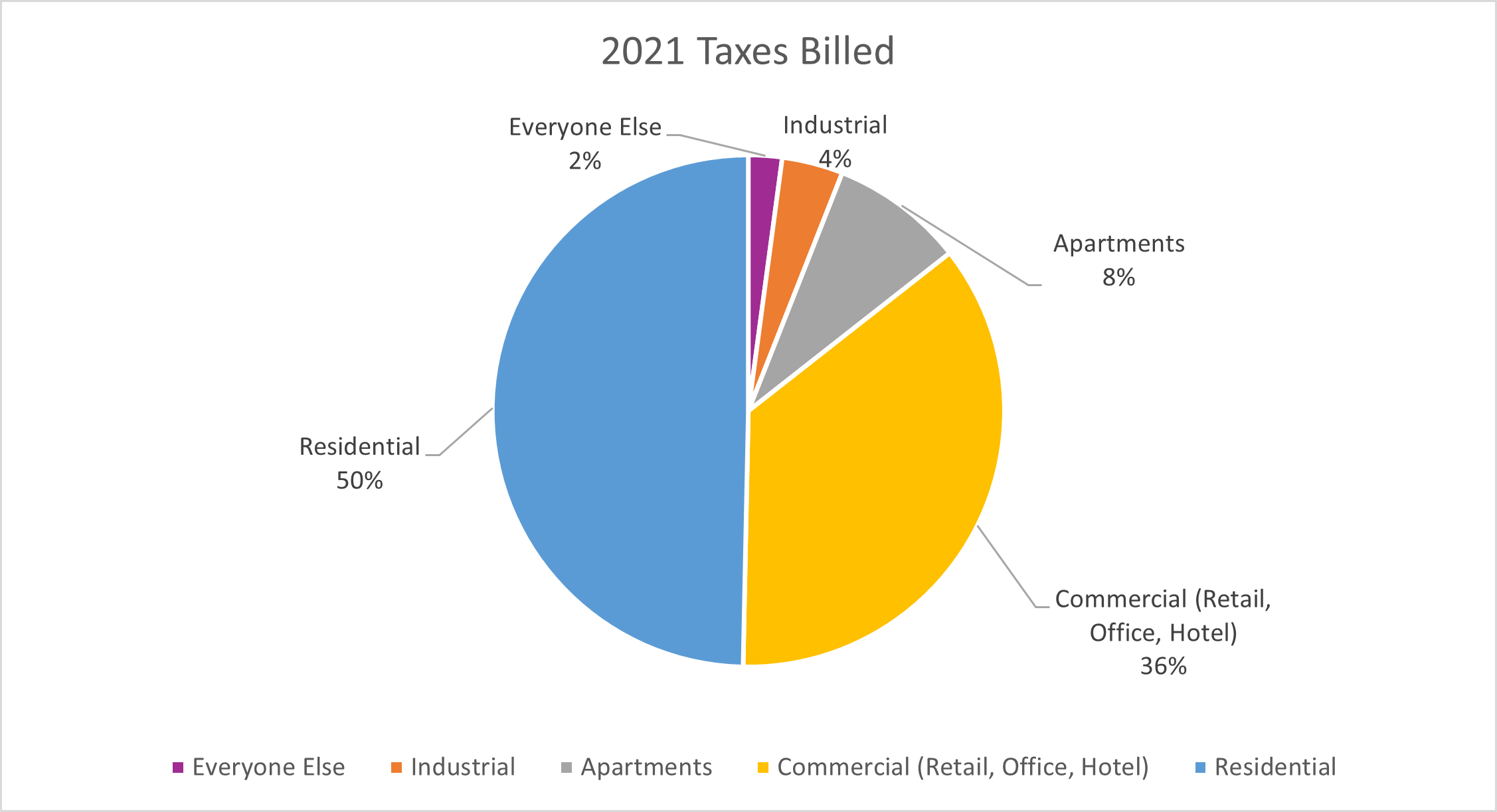

As a group, Chicago’s downtown properties pay over $1.2 billion in property taxes, funding our neighborhood schools, parks, libraries, police officers, and firefighters. Due to Cook County’s unique classification system where commercial properties are assessed at 250 percent the rate of residential properties, commercial properties effectively subsidize residential properties. As a result, Chicago’s single-family homes and condos make up 98% of the property value in Chicago, but pay only 50% of its property tax bills.

Methodology: Data is from the Cook County Assessor’s Office and Cook County Treasurer’s Office for the 2021 reassessment and property tax collections for Chicago. Classification codes are from Cook County Ordinance. “Residential” (single family homes and condominiums) are Class 2 properties, “Apartments” are Class 3, “Industrial” is Class 5B, “Commercial” is Class 5A, and the remaining classifications are listed as “Everyone Else.”

Cook County’s unique property tax classification system – along with high government spending – is the reason Chicago has the highest commercial real estate tax in the nation.

Downtown office buildings are already facing momentous challenges with a collective loss in value projected at 40 to 80%. Recent building sales have reflected that loss, with the last major office building sales selling at deep discounts from 60 to 89 percent. A decrease in commercial building values will result in a significant property tax burden shift to homeowners, projected at 10 to 20 percent.

Not only do we need a thriving downtown to help subsidize property taxes for homeowners across the city, continued investment is also essential to grow our city and expand our tax base. Growing our tax base will help to ensure property taxes for all homeowners are kept in check.

Hiking Chicago’s Transfer Tax to one of the highest in the nation – on top of Chicago now having the highest commercial property tax in the nation--will not only stifle investment and hurt our downtown, but it will also increase property taxes across the entire city.

All neighborhoods will be impacted by the transfer tax hike.

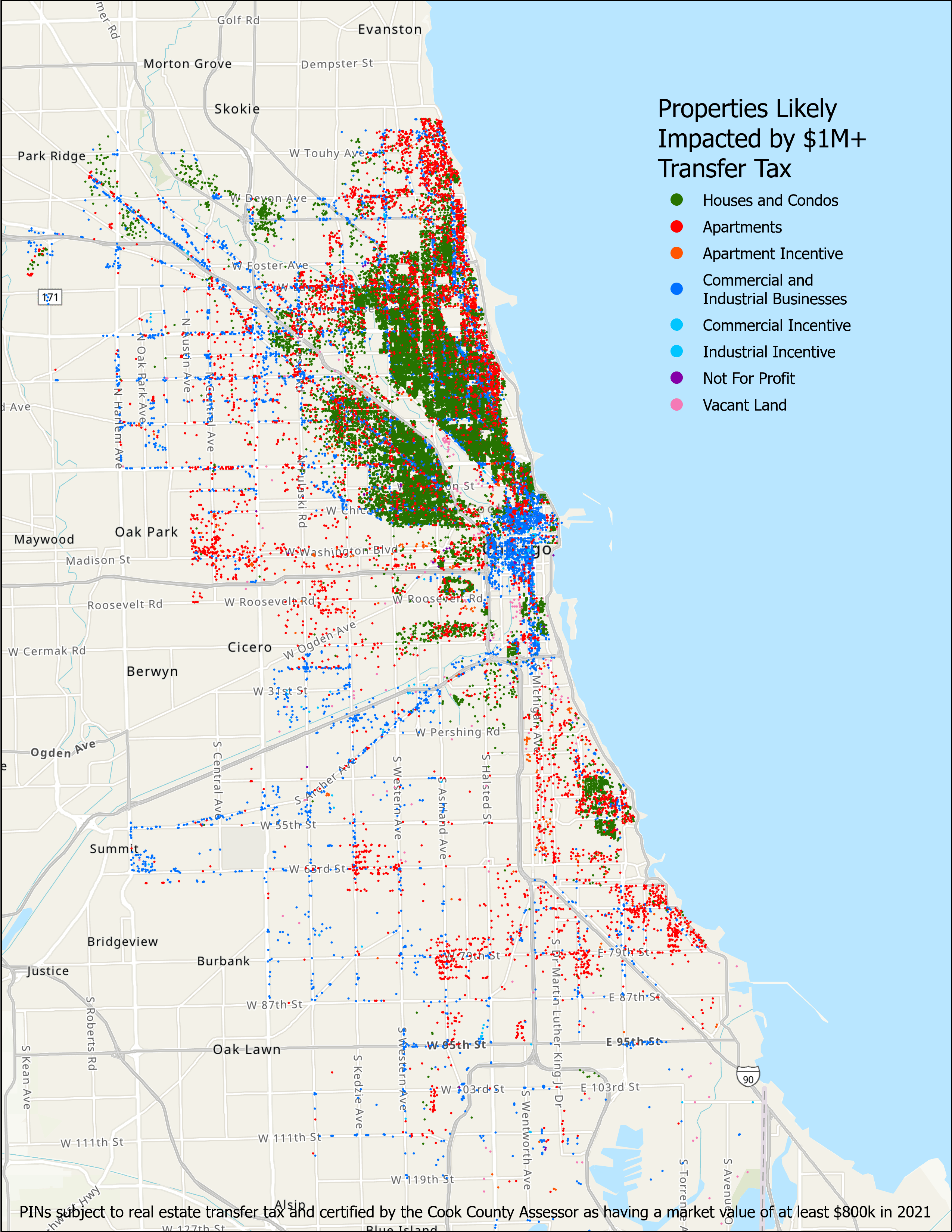

Over 30,000 properties across the city will be subject to tax increases by Mayor Johnson’s transfer tax hike. While Mayor Johnson’s transfer tax hike has been coined a “mansion tax,” grocery stores, restaurants, shopping centers, office buildings, and multi-family buildings in every neighborhood will be taxed. This doesn’t include the 20,000 properties that are on the cusp of being valued at $1M in the coming years.

Methodology: Data is from the Cook County Assessor's Office and Cook County Treasurer’s Office for the 2021 reassessment of Chicago, geocoded using geocod.io based upon street address and mapped using ArcGIS. Fair market value of each property was determined based on the Cook County classification code. All property under a County 2021 fair market value estimate of $800k was removed to isolate those properties for which the $1M threshold is likely to be relevant in an upcoming sale. All commercial and industrial property within City of Chicago Enterprise Zones (~6,000 PINS) were also removed, as they are exempt from the City's transfer tax. Out of the 54,000 properties depicted in the map, 21,000 were assessed by the County with a fair market value estimate between $800k and $1M in 2021. A conservative estimate of the number of properties impacted by changes to the transfer tax at the $1M threshold is 30,000.

After Los Angeles implemented a transfer tax hike in 2023, financing for multi-family housing deals has dried up because the deals no longer penciled out. It is anticipated that Chicago will experience similar outcomes with investors opting for less risky investments and multi-family developments will decline, denying our city the additional housing stock that is so desperately needed.

The Proposed Transfer Tax Structure would create a regressive tax for properties valued under $1M.

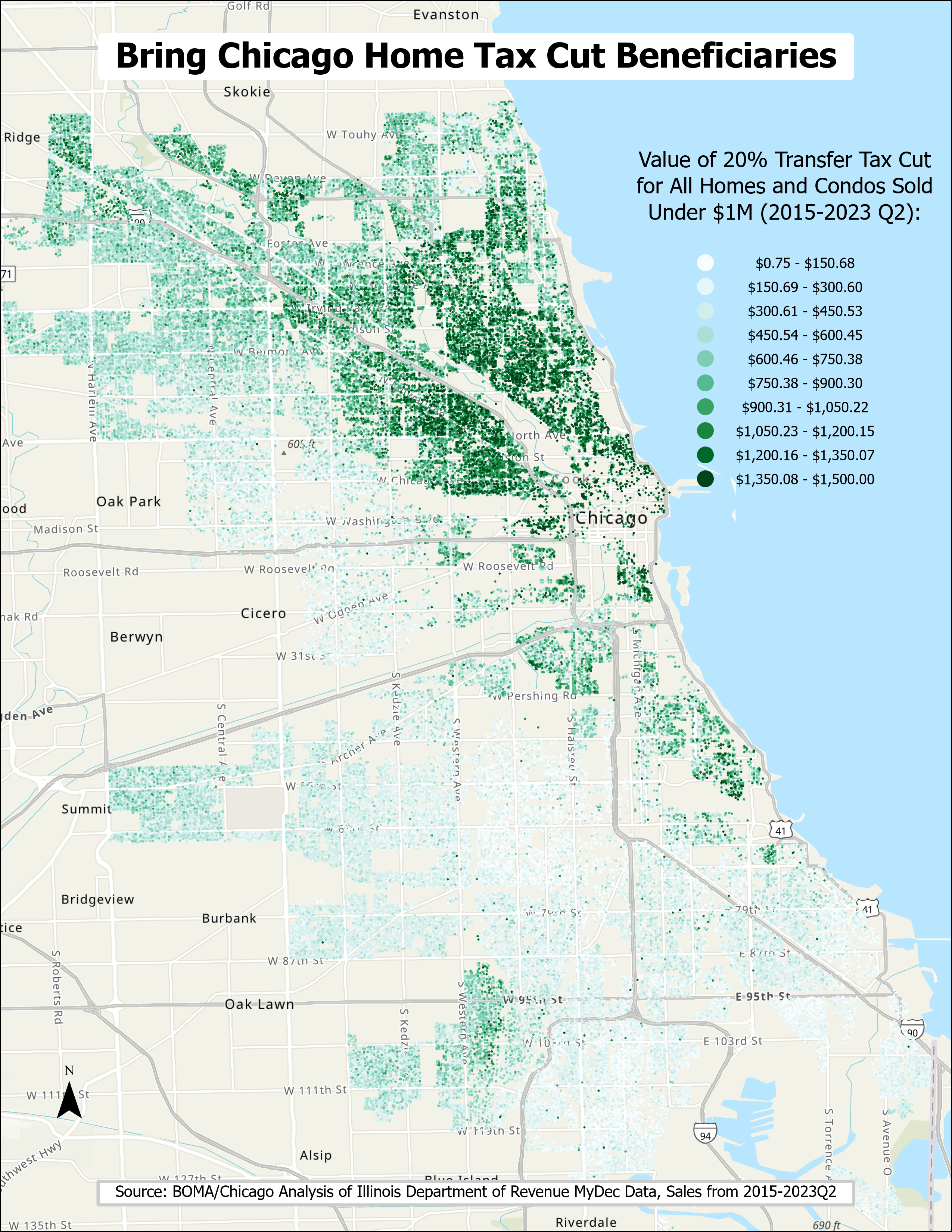

Despite the Bring Chicago Home advocates’ claim that the new tax structure would make the “rich pay their fair share,” the included tax cut is demonstrably regressive.

The flat 20% reduction provides the greatest tax decrease –$1,500 – for owners of $1M homes. Owners of properties valued less will receive only a few hundred dollars in tax cuts. As the map below illustrates, the referendum’s transfer tax decrease predominantly favors homeowners in the generally more affluent North and Northwest sides.

Methodology: Data is from the Illinois Department of Revenue’s MyDec Dataset of recorded home and condominium transfers subject to real estate transfer tax in Chicago from 2015 to Q2 2023. Assuming a flat 20% decrease in the City of Chicago’s portion of the transfer tax was already in place over those years, the reduction in the City’s transfer tax for each individual sale was calculated. The addresses were geocoded using geocod.io and the amount of each tax reduction is mapped using ArcGIS by color saturation to demonstrate which locations received the largest benefit. The color scale organizes the data into 10 equal intervals of tax savings, which are layered upon each other starting from the smallest tax cut to the largest, meaning that the largest tax cuts are always more visible than the smaller tax cuts, in uniformity across the map.

The Referendum Question is confusing and misleading.

BOMA/Chicago, along with a coalition of real estate, contractor and investor groups and individuals, filed a lawsuit in January. The lawsuit contends that the three-part question being posed to voters is confusing and misleading, and violates the Illinois Constitution, Illinois State Statute, and Illinois Supreme Court precedent.

On February 23, the Cook County Circuit Court ruled in favor of BOMA/Chicago, agreeing the question is misleading and directing the Chicago Board of Elections to invalidate the question and not tally the votes. The case is currently on appeal in the First District Appellate Court.

All stakeholders, together, should implement an effective plan to support the homeless.

Homelessness is a pressing issue in our city, and we support the need to create an effective plan to provide housing and services for individuals experiencing homelessness.

However, the transfer tax increase proposed to fund this initiative would hurt commercial buildings, small businesses, homeowners, renters, and neighborhoods across Chicago. It is important to understand the damage that tripling and quadrupling the city’s transfer tax would impose on the city – especially during a time when it is facing economic challenges due to the ongoing pandemic recovery, sluggish return to office, and rising costs and interest rates.

It is critical that all stakeholders work together to develop a plan that is effective and sustainable. In fact, BOMA/Chicago reached out to the Bring Chicago Home coalition and reached out to Chicago's Mayor multiple times to ask to participate in those discussions, as far back as November 2022. Unfortunately, our requests to come to the table and work together to implement real solutions to homelessness were declined.

The last thing Chicago needs is another tax increase.

Solving a problem doesn’t always require a new tax. Before implementing yet another tax on Chicagoans, it’s essential to analyze current policies in place that contribute to homelessness.

There are many policies related to affordable housing that could be revised to reduce costs and encourage greater development across the city. Currently, affordable housing units cost up to $899,000 per unit to build.

Additionally, we should look to other cities that have made strides in reducing homelessness to emulate their policies. For instance, Houston has created a centralized database to track services for the homeless and apply a standardized assessment to ensure those who are homeless receive the services they need and applying a collaborative approach with the city, county, and nonprofit organizations.

Implementing another tax and adding more costs to doing business in Chicago will hurt residents broadly, including the people this proposal is intended to help. Bringing all stakeholders together to develop a real, effective plan is essential to solving Chicago’s homelessness problem.

Without a detailed plan, this new tax revenue will not be used accountably.

There are a number of questions about how previous funds were spent for homelessness programs. Despite nearly $40 million in unspent federal housing dollars, the City continues to ask for more money for housing. And just a few months ago, the City was able to find hundreds of millions of dollars to house migrants.

Mayor Johnson’s Transfer Tax Hike would give the City a blank check with no accountability for spending, even as it has failed to transparently manage the migrant shelter crisis.